A profitable real estate investor employs a strategic approach to boost returns and mitigate risks. One common strategies include acquiring undervalued holdings, modernizing existing structures to increase their value, and creating income through leases. Moreover, investors may specialize in targeted markets or property types that match with their investment goals.

- Due diligence is crucial before pursuing any real estate investment.

- Market analysis can help investors identify profitable possibilities.

- Relationship building with industry professionals is essential for success.

Regardless the chosen strategy, a robust plan and careful implementation are essential for conquering the challenges of the real estate market.

Comprehending Property Law and Regulations

Navigating the intricate world of property law and regulations can be a daunting task for individuals. These complex legal frameworks govern ownership to real estate, establish rights and responsibilities amongst parties, and regulate various aspects of property transactions. To successfully navigate this legal landscape, it is essential to engage with qualified real estate professionals who can offer expert advice.

A thorough understanding of property law and regulations proves indispensable in defending your possessions.

Residential vs Commercial Property: Key Differences

Investing in real estate can be lucrative endeavor, but it's crucial to grasp the distinctions between residential and commercial property before making an investment. Firstly, residential property is designed for habitats, while commercial property aims to space for enterprises. Residential properties often include single-family homes, apartments, and condominiums. In contrast, commercial properties can differ from retail stores and office buildings to manufacturing facilities.

Moreover, the legal and financial aspects of these two property types also vary. For instance, residential leases are often briefer in duration compared to commercial leases. Additionally, zoning regulations and building codes can substantially differ between residential and commercial properties.

Before embarking on a real estate investment journey, it is crucial to thoroughly research and analyze the specific characteristics of both residential and commercial property to make an wise decision that aligns with your objectives.

Increase Your Rental Property Income

Earning a solid return on your investment is the goal for any landlord. To attain this, you need to enhance your rental property income. This involves several strategies, starting with finding the right tenants who will provide rent on time and take good care of your property. Regularly inspect your rental unit for any needed repairs or upgrades to keep it in top condition and attract quality renters. Additionally, consider offering valuable amenities such as a washer/dryer or parking space to entice tenants willing to pay a premium.

- Carefully screening potential tenants is key to minimizing the risk of late rent payments or property damage.

- Review your rental rates with local market conditions in mind to confirm you're charging a competitive price.

- Implement clear lease agreements that outline all expectations and responsibilities for both landlord and tenant.

By implementing these strategies, you can effectively improve your rental property income and create a profitable investment.

Grasping Property Taxes and Assessments

Property taxes are a crucial source of revenue to local governments. They finance essential services such as schools, roads, or public safety. Assessments determine the value of your property, which directly influences the amount of tax you pay. This process involves various factors including location, size, and condition.

To understand your property taxes completely, it's important to review your assessment notice carefully. It will outline the assessed value of your property and the tax more info rate levied. You can also contact your local tax assessor's office for any questions or concerns you may have.

Property taxes are a significant financial obligation. By understanding the assessment process and one's tax liability, you can guarantee that you are paying your fair share and supporting vital community services.

The Future of Property Ownership in a Digital Age

As digital advancements rapidly evolves, notions around property ownership is undergoing a profound transformation. The convergence of the physical and digital worlds is blurring traditional boundaries, creating opportunities for how we utilize property. Blockchain are gaining traction as tools for managing ownership in a online landscape. This change is paving the way for novel models of property control, potentially democratizing to opportunities.

- Smart contracts are poised to disrupt the real estate market by expediting transactions and reducing complexity.

- Immersive technologies are allowing new ways to interact with properties, overcoming geographical barriers.

- The metaverse are offering opportunities for engagement in virtual spaces, raising questions about the definition of ownership in a multidimensional digital realm.

In light of these transformative changes, it remains to be seen how regulations will adapt to the challenges and avenues presented by the digital age.

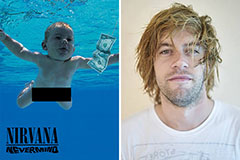

Spencer Elden Then & Now!

Spencer Elden Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!